Limit Order & Take Profit Intent

Limit Order & Take Profit Intent

Imagine navigating the volatile seas of DeFi trading, where each decision could lead to profit or loss. The Limit Order & Take Profit Intent enters here as your strategic compass. In essence, a dual directive defines the Intent: one order aims to capture profits if the price increases, while the other limits losses if it decreases. One order activates and immediately vanishes the other, displaying a smart balance between greed and caution.

But why is this mechanism crucial for your trading arsenal? The DeFi market, with its rapid fluctuations, demands not just attention but also a safety net. This safety net role belongs to this Intent, ensuring your trading strategy embraces both ambition and security.

This guide shows how our the Limit Order & Take Profit Intent simplifies complex strategies but also aligns them with the dynamism of DeFi trading. Ready to steer your trading journey with confidence and precision? Let’s dive deeper!

Key Takeaways

- Asset Protection: The Intent manage potential entry and exit points, offering a dual advantage, especially crucial for those who cannot afford to monitor market movements constantly.

- Exploiting Profit Opportunities: They turn market volatility into an advantage, ideal for strategies aiming to capitalize on sudden price movements.

- Strategic Trade Automation: This Intent automates these strategies, allowing traders to benefit from both rising and falling market conditions without needing to intervene manually, thus streamlining decision-making and efficiency.

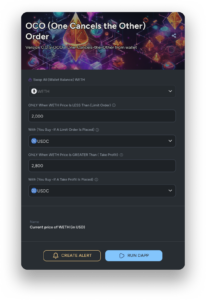

Selecting Your Trading Asset

Employing the Limit Order & Take Profit Intent effectively starts with choosing the right asset. Consider the asset’s market behavior and your familiarity with its trends. The Limit Order & Take Profit Intent supports a wide range of coins and tokens, enabling you to apply this strategy to the assets you’re most confident in trading.

Setting Your Price Targets

Price Ceiling for Selling

Set your sell limit order by analyzing market trends, potential resistance levels, and your profit goals. This is the price at which you aim to sell the asset for a gain, activated if the market price reaches this point.

Price Floor for Selling

Define your stop-loss order to minimize losses if the market takes an unfavorable turn. This decision should factor in your risk tolerance and the asset’s volatility, marking the lowest price at which you’re willing to sell.

Authorizing the Transaction

Review your Intent details carefully and run a simulation before confirming. This step ensures your strategy is executed precisely as planned, with both orders ready to activate in response to market movements. Once you authorize the transaction, your strategy is set in motion, fully automated.

Conclusion

The Limit Order & Take Profit Intent redefines strategic trading within the DeFi space, offering traders a powerful tool to navigate the complexities of the market with confidence and precision. By integrating asset protection, profit exploitation, and trade automation into one seamless application, it empowers traders to optimize their strategies and achieve their trading objectives more effectively. Whether you’re a seasoned trader or new to the DeFi realm, the Limit Order & Take Profit Intent is your key to unlocking a more strategic, efficient, and risk-aware trading experience. Embrace this innovative tool and transform your trading approach to thrive in the dynamic world of DeFi.

Click here to open the Intent

FAQs

How does this Intent differ from traditional trading platforms?

The Intent integrates directly with the DeFi ecosystem, offering automation and strategic flexibility that traditional platforms often lack, particularly in automating orders based on real-time market conditions.

Can The Limit Order & Take Profit Intent be used by beginners in the DeFi space?

Absolutely. While beneficial for experienced traders, a user-friendly interface characterizes the Intent design that makes it accessible for beginners, offering a straightforward way to implement advanced trading strategies.

What are the main risks of using the The Limit Order & Take Profit Intent?

As with any trading strategy, the main risks involve market volatility and the potential for unexpected market movements. However, this design of the Intent aims to mitigate these risks by allowing traders to set predefined loss thresholds.

How the Limit Order & Take Profit Intent order DApp was built?

The Intent was swiftly put together using our Intent Builder. It’s a straightforward, code-free tool for crafting DApps powered by the Smart Transaction Technology.

Follow along with this guide for a step-by-step on creating an Limit Order & Take Profit Intent