CeFi Tools for DeFi Trading

Imagine having full control of your assets, securely held in your own wallet, accumulate tokens with MEV protection, and being among the first to invest in a token long before it hits a centralized exchange. In DeFi, this could be achievable. The moment a token lists on a centralized exchange (CEX), it has often already experienced significant gains in most DEXs, gains that early adopters have been able to capitalize on. If you’re only trading on CEX platforms, you may be missing out on these many high-profit opportunities.

But there’s a reason some traders hesitate to dive into DeFi: the lack of essential trading tools. Unlike CeFi, where stop-loss, take-profit, and trailing orders are the standard, DeFi has left traders without these key features, until now.

With new tools that bring the same CeFi capabilities to DeFi, there’s no reason not to take full advantage of DeFi’s opportunities. You can now trade with stop-loss, take-profit, and trailing orders, all while keeping full control of your assets, directly from your wallet and on any token out there.

Curious how you can maximize these opportunities and trade as you do in CeFi, but with all the advantages of DeFi? Keep reading to discover how Intentable’s new tools allow you to unlock DeFi’s full potential.

Why DeFi Matters to Traders

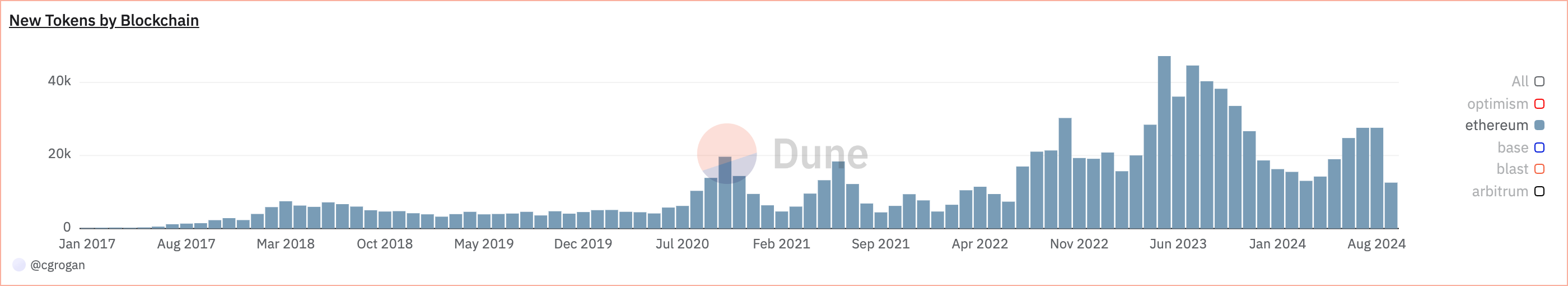

DeFi has become a gateway to a vast universe of new tokens and projects that aren’t available on traditional centralized exchanges. In fact, since January 2024 alone, there have been approximately 90,000 to 100,000 new tokens launched on Ethereum alone, according to data from Dune Analytics. These tokens launch directly on decentralized platforms, offering early adopters the chance to invest before they hit mainstream exchanges.

However, not all of these tokens succeed. Many launch with hype, only to quickly decrease in value, leaving traders exposed to significant risk. To navigate this volatile environment, traders need the right tools—tools that help manage risk and protect investments as they would on centralized exchanges.

Bridging the Gap Between CeFi and DeFi

One of the main barriers in DeFi trading is the lack of sophisticated trading tools that help manage risk and automate strategies. In centralized finance (CeFi), traders have long benefited from features like stop-loss orders, take-profit levels, and trailing stops. Bringing these tools into the DeFi space empowers traders to:

- Manage Risk Effectively: Set predefined exit points to protect against significant losses.

- Automate Trading Strategies: Execute trades automatically based on market conditions.

- Maintain Control: Trade directly from your wallet without relying on centralized platforms.

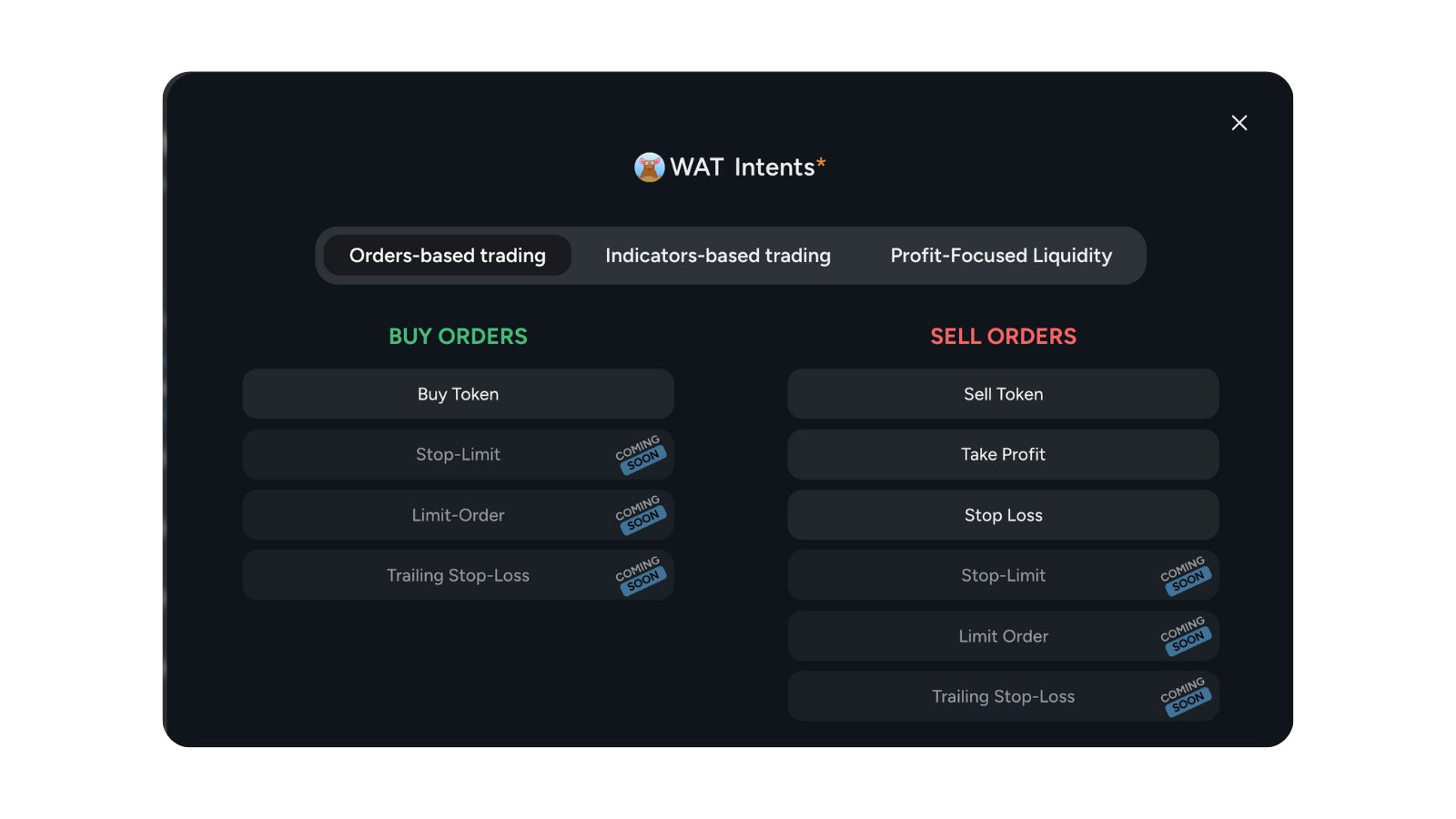

CeFi Tools for DeFi Trading at Your Fingertips

1. Stop-Loss and Take-Profit Orders

These orders allow you to set price levels at which your position will automatically close. This means you don’t have to monitor your meme tokens 24/7.

- Stop-Loss: Limits potential losses by closing a trade if the price drops to a certain level and swap your token to wETH.

- Take-Profit: Secures profits by closing a trade once a specific profit target is reached and swap your token to wETH.

2. Trailing Orders

Trailing orders adjust your stop-loss or take-profit levels automatically as the market moves in your favor. This helps you lock in profits while giving your trades room to grow.

3. Automation

Automating your trading strategies saves time and reduces emotional decision-making. With automation, you can execute complex strategies consistently and efficiently, even when you’re not actively monitoring the market.

With Intentable, you can take automation to the next level by connecting any protocol to another, allowing you to build sophisticated strategies tailored to your needs. For example, you could combine Uniswap with Chainlink for stablecoins de-pegging protection, ensuring that your assets are secured against sudden price fluctuations. Or, you could integrate Rocketpool and Aave to create a re-staking and loan loop, maximizing your earnings by staking assets and borrowing against them in a continuous cycle.

These flexible automations give you the power to customize and optimize your DeFi strategies, making your trading more dynamic and efficient.

Protecting Your Trades with MEV Protection and Filtered Token Lists

While many new tokens have the potential for significant gains, others—whether due to low liquidity, scams, or simple market failure—often crash or become worthless. To help traders navigate this volatile landscape, Intentable not only provides access to new tokens but also offers a comprehensive suite of protections to safeguard your trades.

First, we provide built-in MEV protection for every token purchased through our platform. Maximal Extractable Value (MEV) refers to the potential profit miners can make by reordering or manipulating transactions within a block. This manipulation often leads to front-running and other unfair practices, leaving traders exposed to losses. With our MEV protection, your trades are shielded from these tactics, ensuring a fair and secure trading environment.

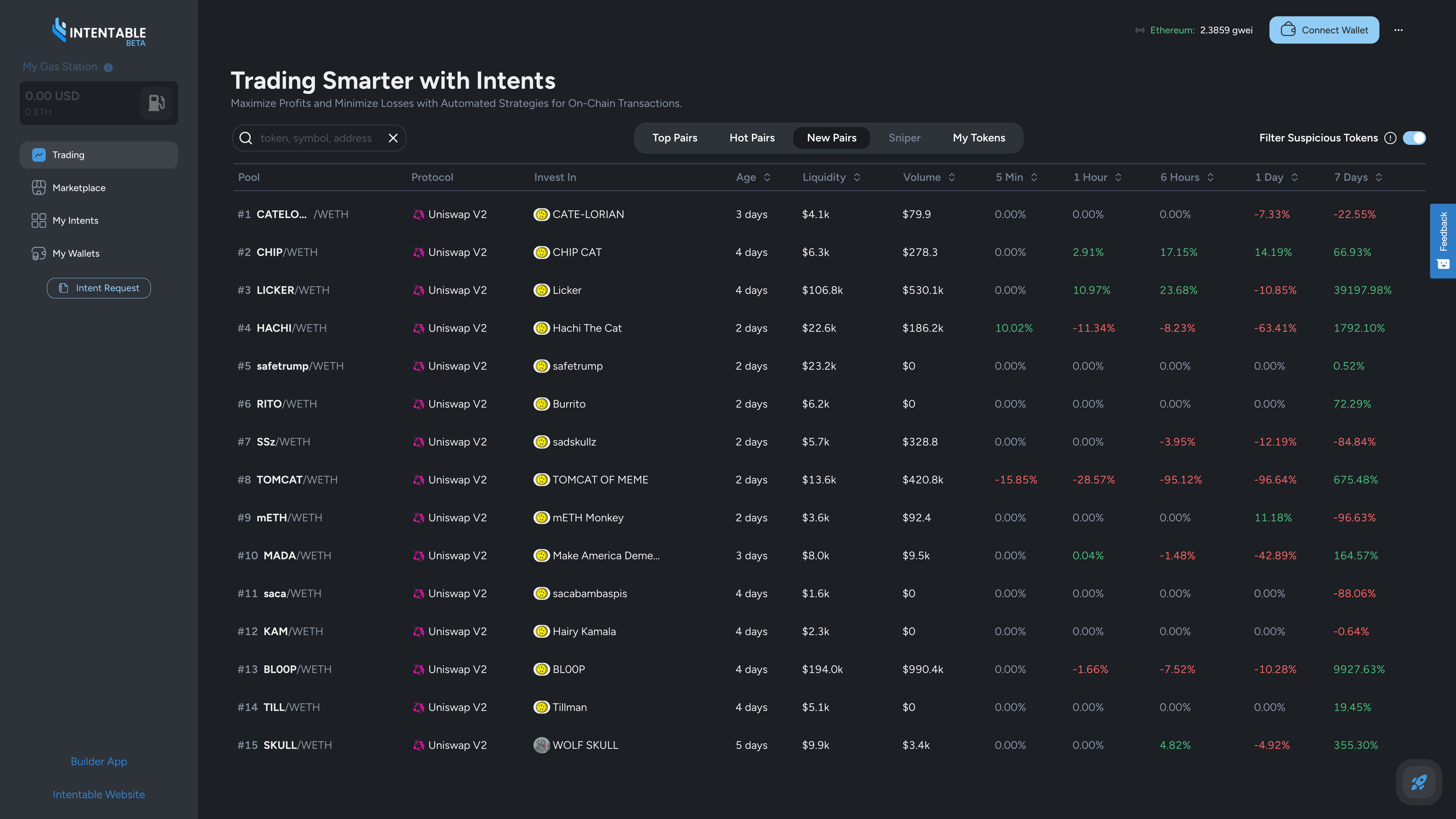

But we don’t stop there. To further protect our traders, we offer filtered token lists. These lists help you avoid potential pitfalls by highlighting:

- Top Pairs: Established tokens with high liquidity.

- Hot Pairs: Trending tokens with significant trading activity.

- New Pairs: Freshly launched tokens, filtered for safety.

Our filtered token lists exclude tokens with too low liquidity, potential scams, honey pots, and other red flags such as suspiciously similar contracts. This extra layer of protection allows you to trade with confidence, knowing you’re avoiding common DeFi traps while still being able to seize early opportunities in promising new tokens.

With these protections in place, and the CeFi level trading tools, traders get a powerful suite of tools the utilize DeFi to their trading.

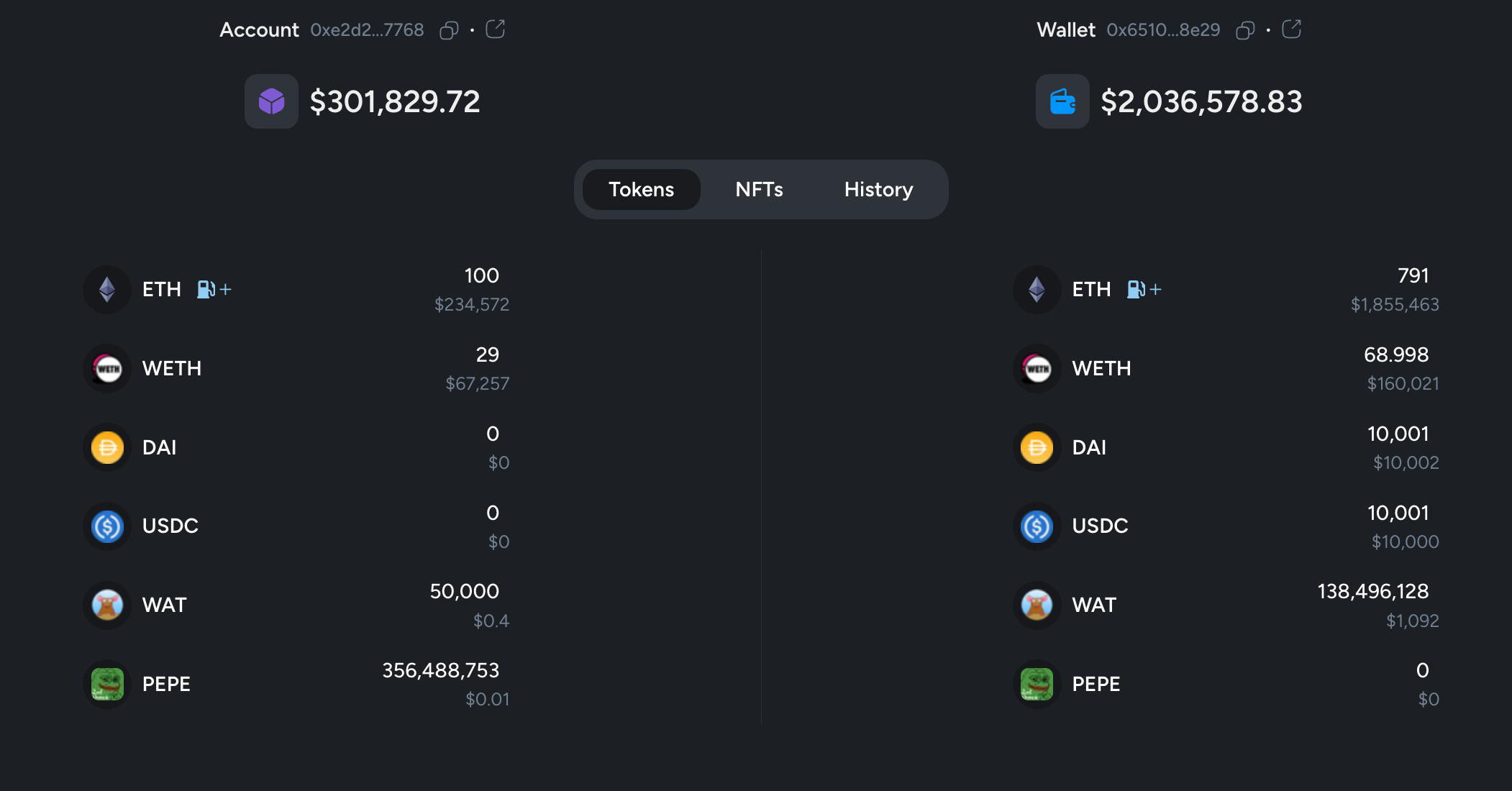

Trading Directly from Your Wallet—Fully Decentralized

Trading from your own wallet means you retain full control over your assets. There’s no need to deposit funds into a centralized exchange, significantly reducing the risk of hacks, withdrawal limitations, or insolvency issues that can arise with centralized platforms.

Getting started is simple. It takes just 2 minutes to connect your wallet to the Intentable platform, and by creating an account abstraction, you can immediately begin trading with advanced tools like stop-loss, take-profit, and automation—right from your wallet. It’s as easy as connecting your wallet and setting up your account, and you’re ready to go.

Conclusion

DeFi opens up a world of possibilities with early access to new tokens, more control over your assets, and advanced strategies that CeFi traders could only dream of. But with great opportunity comes great risk—especially when dealing with the volatility of new tokens. That’s why having the right tools at your disposal makes all the difference.

With Intentable, you get the best of both worlds – CeFi Tools for DeFi Trading: the ability to trade directly from your wallet, combined with advanced CeFi-level tools like stop-loss, take-profit, trailing orders, and automation. Plus, with built-in MEV protection and filtered token lists, you can trade confidently, knowing your assets are safeguarded.

Ready to take your DeFi trading to the next level? Connect your wallet and start using Intentable’s powerful trading tools in just 2 minutes. Don’t miss out on the next big opportunity—trade smart, trade safe, and take full control of your assets with Intentable today.